Planning a milestone (and maybe the last) family trip before my daughter starts working. My daughter bought Diptyque perfume in Paris, but we couldn’t get it tax-free in France, so we had to go to Barcelona… Extra: Eurozone tax-free procedures in Barcelona

目次

Purchased in Paris. Planned to apply for tax refund in France…

My daughter bought Diptyque perfume in Paris, and the tax-free (VAT: TAX FREE) application form was filled out at the Diptyque store, but to get the tax refund, I need to prove it and apply at the airport.

So, on the morning of the day we left France (heading to Barcelona), we had planned to apply at Charles de Gaulle Airport. However, by 5am, when we were supposed to be boarding the first flight in the morning (departing at 6:30am), we had to go through the procedures at the airport, and unfortunately the VAT (TAX FREE) office at Charles de Gaulle Airport was closed, so we had to give up on applying for tax exemption. Of course, there was no other way.

Shopping at Diptyque is featured here 家族旅行(ヨーロッパ周遊):③パリ編 part2

After doing a lot of research

I hadn’t originally planned on making any purchases that would require a tax-free application (VAT: TAX FREE), but after purchasing this perfume, I started looking into how to apply for tax-free (VAT: TAX FREE) in Paris (France). Naturally, the main focus was on how to apply at Charles de Gaulle Airport, but I discovered that it was possible to apply if you were within the Eurozone.

However, I couldn’t find any articles that explained how to do that.

Application challenge in Barcelona (within the Eurozone)

Believing the article that said that items purchased in Paris could be applied for within the Eurozone, I tried applying at El Prat Airport on the morning of the day I left Barcelona (heading to London).

First, I looked for the tax-free (VAT: TAX FREE) application office, and fortunately, I soon found one just behind the check-in counter.

Although it was 5am, just like in Paris, the office was open.

However, there was only an attendant at the KIOSK (electronic terminal) side, and no one at the counter (manned counter).

Since the document was issued in Paris (France), I was worried that the kiosk (electronic terminal) would not accept it, so I tried to scan the barcode on the terminal, and sure enough, the screen showed that it was not accepted.

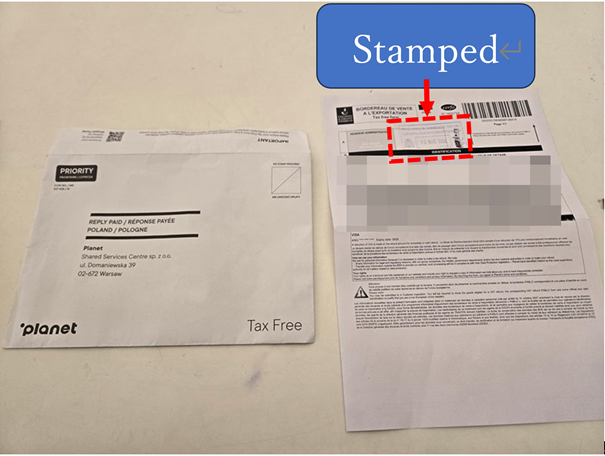

I didn’t give up here, so I called out to a nearby staff member and explained the situation, and he guided me to the next counter (a manned counter), where the staff member personally stamped the document with a certification seal. This meant that the application process was successful, and all that was left to do was submit the documents.

Submit application in Barcelona (within the Eurozone)

Although I couldn’t apply electronically, I was able to submit the complete application by getting a certification stamp on my documents.

I asked the staff and they told me that I just had to drop the application in the postbox in front of me.

When I looked, I saw a very eye-catching yellow postbox.

Application complete. I found out that I could apply for tax exemption (VAT: TAX FREE) within the Eurozone.

Result of Refund

Refund successful. -\1,705

Proof that refunds are possible even if the country is different, as long as it is within the Eurozone.

11st Jan.2025 Purchase date @Paris

15th Jan.2025 Tax refund application date @Barcelona

28th Feb.2025 Refund confirmation date @Card

コメント